Financial Accounting refers to the identifying, measuring, and communicating financial information to help investors and other external stakeholders make informed decisions. This information is presented in an Income Statement (also referred to as Profit & Loss Statement), Balance Sheet, and other financial statements conforming to Generally Accepted Accounting Principles (GAAP). A bookkeeper or CPA should be tasked with generating these reports on a routine basis through an accounting system, such as QuickBooks, as they will help management make informed business decisions. In addition, external stakeholders, such as bank lenders, may require your company to provide such reports.

In order to generate useful financial statements, the Chart of Accounts (COA) should be organized in a way that makes sense for your flight school. The Chart of Accounts includes accounts presented on both the Income Statement and Balance Sheet. Examples of accounts that might be applicable to your flight school are provided below. Depending on the size of your operation, the Chart of Accounts may become quite lengthy, but here is a simple example in QuickBooks:

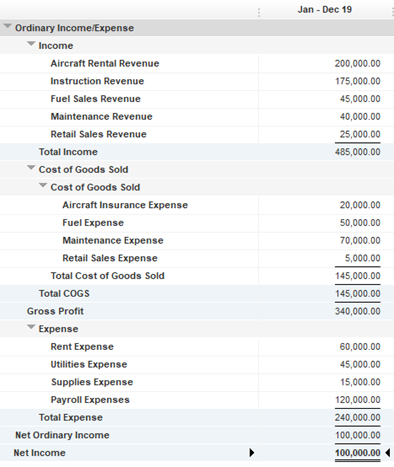

The Income Statement (I/S) shows profit earned over a given period, generally organized by core business segments. Revenue is netted with Cost of Goods Sold (or Cost of Sales) to get Gross Profit. For a flight school, revenue accounts may include aircraft rental revenue, instruction revenue and retail sales revenue, and cost of goods sold accounts might include aircraft insurance expense, fuel expense, maintenance expense and retail sales expense. Netting Revenue with Cost of Goods Sold for each business segment provides Gross Profit for each core business activity. This is very helpful for understanding the profitability and, therefore, the performance of different business areas. Overhead Expenses are organized below Gross Income on the Income Statement. They are netted with Gross Income providing Net Income. Overhead expenses include rent expense, utilities expense, supplies expense and any other expenses not directly related to a specific revenue stream. The key benefit of the Income Statement is quickly determining overall profitability of your business as well as understanding profitability by business segment.

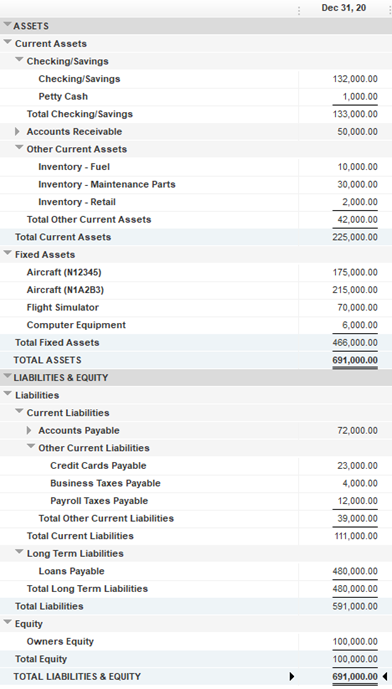

The Balance Sheet (BS) shows the financial position of a company at a given point in time. As the name implies, this report balances your Assets with your Liabilities and Owner’s Equity. After summing all Assets and subtracting Liabilities, the residual is Owner’s Equity. This can be distributed to shareholders (Owners) or retained as equity for investing in business growth. Asset accounts for your flight school might include checking/savings, petty cash, accounts receivable, inventory and fixed assets. Typically, assets with significant value such as airplanes, are itemized as their own subaccounts, while lower value assets such as employee computers, are combined under one subaccount – computer equipment. Liability accounts might include accounts payable, credit cards payable, business taxes payable, loans payable and payroll taxes payable.

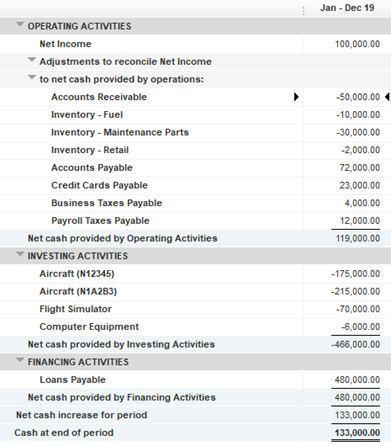

Another useful financial statement is the Statement of Cash Flows which summarizes your company’s change is cash position over a given period of time. This statement breaks down changes in cash position into three categories: Cashflow from Operating Activities, Investing Activities and Financing Activities. Remember, cash flow is a different concept than income. While many cash inflows and outflows are reflected as revenue and expenses on the Income Statement, many are not. For example, cash flow from financing activities (such as loan principal payments or disbursements), or cash flow from investing activities (such as payment for a new piece of equipment or airplane) are not reflected on Income Statement. Similarly, not all Income Statement activity is reflected on the Statement of Cash Flows. For example, depreciation expense (an expense on the Income Statement) is not a cash outflow, are therefore, not something that affects you company’s cash position.

As a small business, you may record your revenue on a Cash Basis, which only includes bills you have recorded and money you have received. If you plan any amount of growth, it is recommended you consider switching to an Accrual Basis, meaning your financials are calculated based on bills you have received but not paid and money you are owed but have not received. This is a much more accurate depiction of cash flow and your accountant or CPA will help determine which method is best for your business given its stage.

See our post on setting up items in NeedleNine to seamlessly sync transactions with QuickBooks and provide you real-time financial accounting insights.

Recent Comments